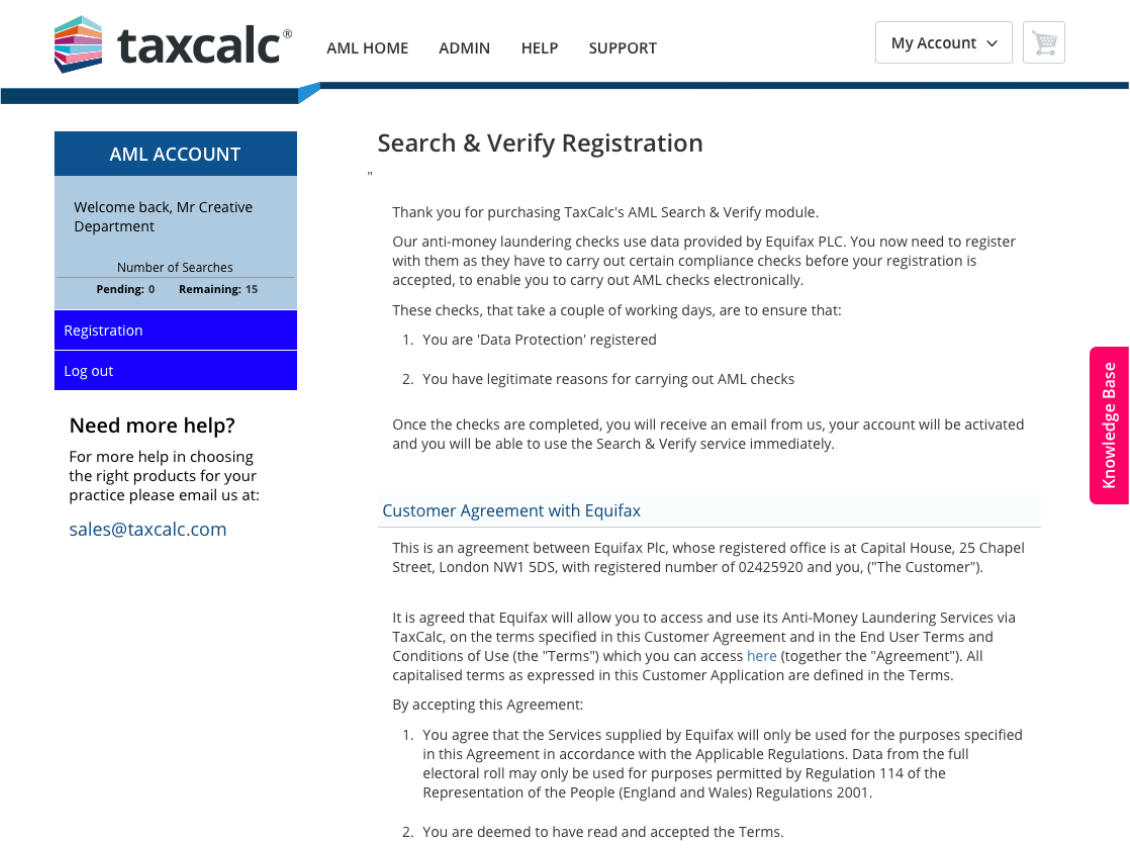

Check Anti Money Laundering Registration

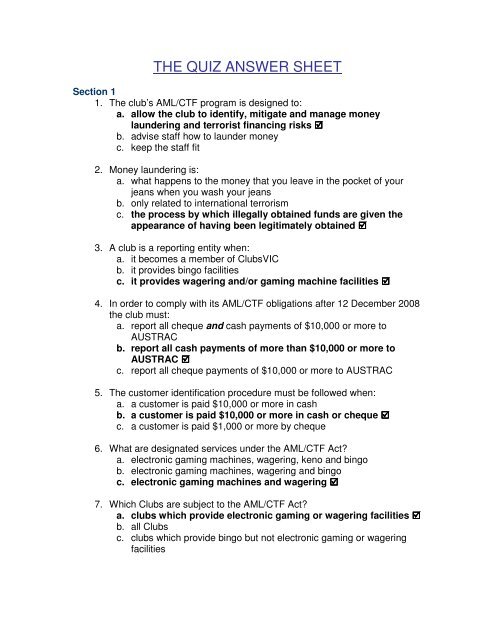

The concept of money laundering is essential to be understood for those working in the monetary sector. It is a course of by which dirty money is converted into clear cash. The sources of the cash in actual are prison and the money is invested in a way that makes it seem like clean cash and conceal the id of the felony part of the money earned.

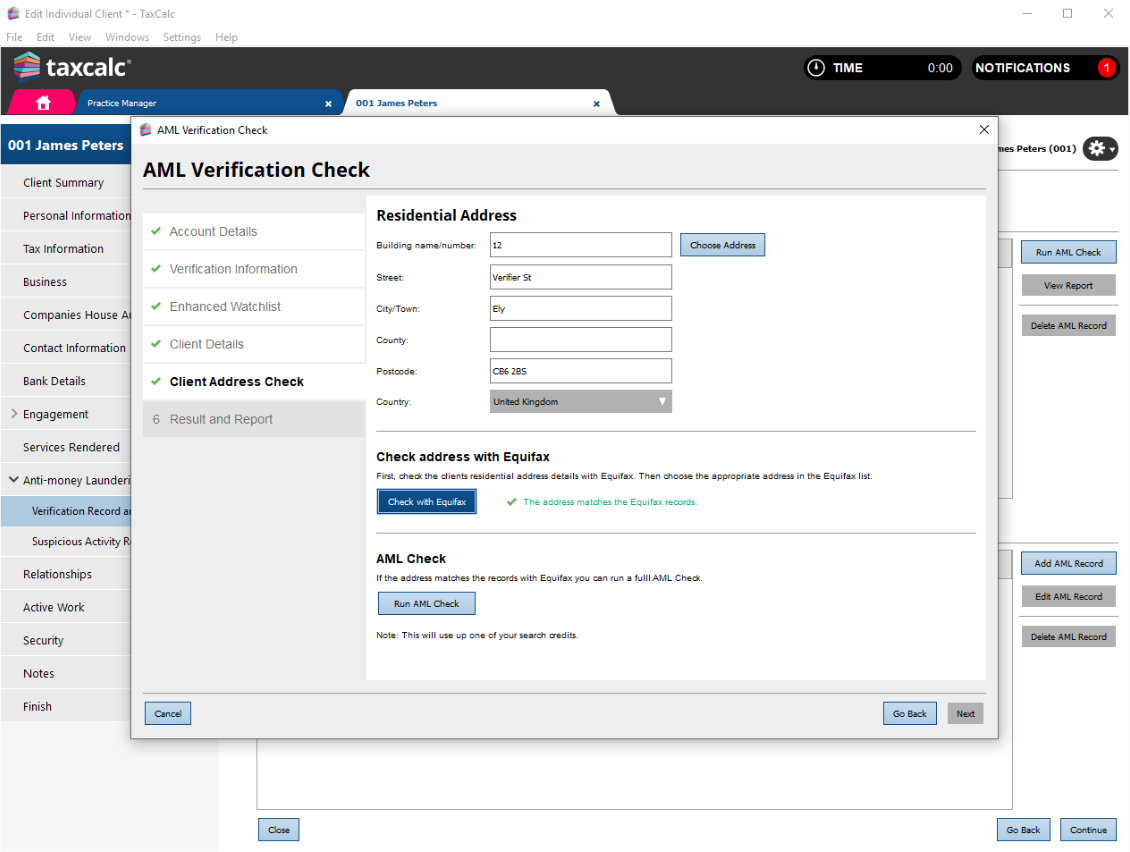

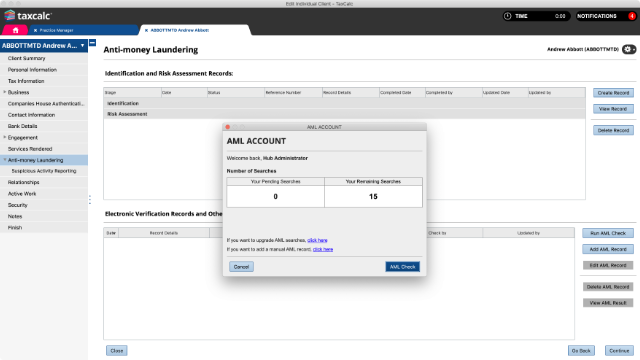

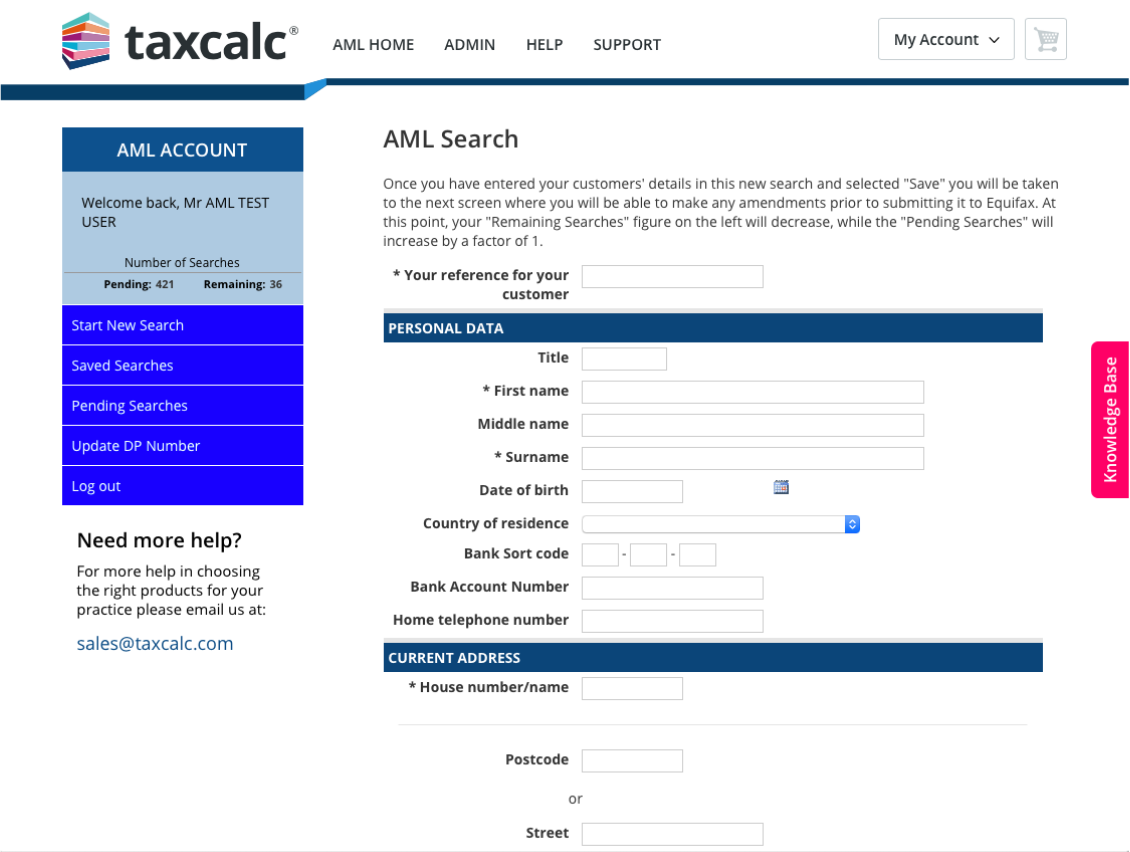

While executing the monetary transactions and establishing relationship with the new clients or sustaining current customers the obligation of adopting satisfactory measures lie on every one who is a part of the group. The identification of such aspect at first is straightforward to deal with instead realizing and encountering such situations later on in the transaction stage. The central financial institution in any nation gives full guides to AML and CFT to fight such actions. These polices when adopted and exercised by banks religiously provide enough security to the banks to deter such situations.

Estate Agents Hit With Surprise Hmrc Inspections Vinciworks Blog

Anti Money Laundering And Counter Terrorism Financing

For Real Estate Brokers How To Register With The Anti Money Laundering Council Amlc Youtube

Anti Money Laundering 2021 Romania Iclg

The Aml And Ctf Approach Our Checklist For Successful Kyc Compliance

Anti Money Laundering What Is Aml Compliance And Why Is It Important

Icai Certificate Course Registration 2021 Out Check Anti Money

A Guide To Anti Money Laundering Aml Compliance Veriff

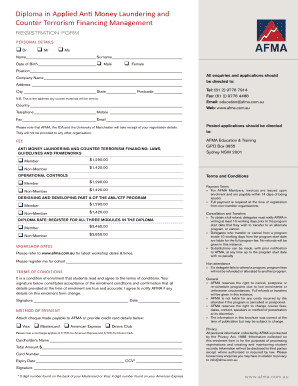

Fillable Online Diploma In Applied Anti Money Laundering And Counter Terrorism Financing Management Registration Form Personal Details Q Dr Q Mr Q Ms Name Surname Date Of Birth Q Male Q Female

Ultimate Beneficial Ownership And The Fifth Directive Vinciworks Blog

The world of regulations can seem like a bowl of alphabet soup at times. US cash laundering regulations aren't any exception. We have now compiled an inventory of the highest ten cash laundering acronyms and their definitions. TMP Danger is consulting firm centered on protecting monetary providers by lowering risk, fraud and losses. We have large financial institution experience in operational and regulatory risk. Now we have a strong background in program administration, regulatory and operational risk in addition to Lean Six Sigma and Business Process Outsourcing.

Thus money laundering brings many adverse penalties to the group because of the dangers it presents. It increases the probability of main dangers and the chance cost of the bank and finally causes the bank to face losses.