What Does Integration Mean In Anti-money Laundering

The idea of cash laundering is very important to be understood for those working within the financial sector. It is a process by which dirty money is converted into clean cash. The sources of the cash in actual are legal and the money is invested in a method that makes it appear to be clear cash and conceal the id of the felony part of the money earned.

Whereas executing the monetary transactions and establishing relationship with the brand new prospects or maintaining present clients the responsibility of adopting enough measures lie on every one who is part of the organization. The identification of such element to start with is simple to cope with instead realizing and encountering such situations later on within the transaction stage. The central bank in any nation supplies full guides to AML and CFT to combat such activities. These polices when adopted and exercised by banks religiously provide sufficient security to the banks to deter such situations.

What is anti-money laundering. Anti-money launderingmore commonly referred to by its shorthand AMLis a system of controls to prevent detect and report the above money-laundering activities.

Anti Money Laundering Software Market To Rise At Cagr Of 13

Integration is the process of making purchases that make it possible to hide stolen cash.

What does integration mean in anti-money laundering. Thats because all that cleaning comes at a cost. Anti-money laundering AML refers to the laws regulations and procedures intended to prevent criminals from disguising illegally obtained funds as legitimate income. Finding freezing and forfeiture of criminal assets.

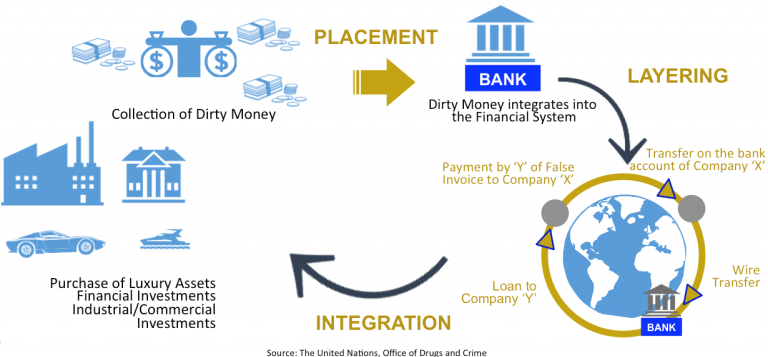

Sale of property to integrate laundered money back into the economy is a common practice amongst criminals. Note that the final sum the money launderers acquire is invariably smaller than the initial sum they started with. The integration phase often referred to as the third and last stage of the classic money laundering process places laundered funds back into the economy by re-entering the funds into the financial system and giving them the appearance of legitimacy.

What is AML transactions monitoring. The final stage is where the money is returned to the criminal from what seem to be legitimate sources. Layering can involve electronic transactions such as wires and ACHs paper transactions andor manual movement of the funds between countries using covert means.

Laundering is not always followed by all three steps. To ensure you understand the stages of money laundering lets delve into the most frequently asked questions about what money laundering is the three stages of money laundering and what to do if you have been accused of money laundering. Guide to anti-money laundering checks Businesses in the affected sectors have to constantly adapt to a plethora of laws directives and regulations.

Anti money laundering transactions monitoring allows controlling the transaction proceedings preventing possible risks. Anti-money laundering AML is a term mainly used in the financial and legal industries to describe the legal controls that require financial institutions and other regulated entities to prevent detect and report money laundering activities. AML comprises the three Fs.

The final stage in money laundering cycle is INTEGRATION. Anti Money Laundering AML Definition Anti-money laundering refers to laws and regulations intended to stop criminals from disguising illegally obtained funds as legitimate income. This stage involves converting the proceeds of crime into another form and creating complex layers of financial dealing to disguise the audit trail.

The Integration Stage Investment. Anti-money laundering refers to all policies and regulations that are in place to prevent the abuse of legitimate financial systems to hide or disguise the proceeds of crime. For instance many criminal groups use shell companies to buy property.

In the final phase of money laundering integration the money is placed into legitimate business or personal investments. It prevents criminals from recovering illegal gains of their crimes as well as using the money for future criminal activity. The term refers to a broad swath of laws regulations directives and procedures that exist to prohibit or stop the laundering of illegal money.

Hence proceeds from the sale would be considered legitimate. Given the regulatory scrutiny on money laundering in most jurisdictions criminals must develop a laundering process that evades anti-money laundering AML controls. The final step is integration when the launderer gets their dirty money back which is now clean and considered perfectly legal wealth acquired through legitimate means.

It is at the integration stage where the money is returned to the criminal from what seem to be legitimate sources. Those laundering the funds may also decide to use non-traditional financial systems such as Hawala Middle East Hundi India or Hui Kuan Hong Kong which are alternative remittance systems that allow for the movement of money without. To this end criminals incorporate layering into the process to better conceal the illegal source of their funds.

They are usually mixed overlapped or reordered. In this stage money comes back to owner or criminal from the sources appearing to be legitimate and is integrated. The Integration Stage The final stage of the money laundering process is termed the integration stage.

AML is an abbreviation for anti-money laundering. It may be used to purchase high-end luxury goods Normal Goods Normal goods are a type of goods whose demand shows a direct relationship with a consumers income. Money laundering is one of the most common forms of organised crime in the UK.

Pdf Anti Money Laundering Regulations And Its Effectiveness

Ppt Anti Money Laundering Awareness Training Powerpoint Presentation Id 730997

What Is Anti Money Laundering Aml Anti Money Laundering

Analysis Of The Global Anti Money Laundering Software Market And Forecast Report For 2022 By Marketresearchglob Issuu

Aml What Is Anti Money Laundering And Why Does It Matter Mintos Blog

Layering Aml Anti Money Laundering

Layering Aml Anti Money Laundering

Infographic Of Anti Money Laundering Aml Analysis Raconteur Net Money Laundering Finance Infographic Infographic

Layering Aml Anti Money Laundering

Ppt Anti Money Laundering Powerpoint Presentation Free Download Id 3105670

Anti Money Laundering Overview Process And History

Anti Money Laundering In Indonesia What You Need To Know

How Dynamic Client Risk Profiling Leads To Stronger Anti Money Laundering Compliance Enterprise Risk Management Software Businessforensics

International Banking Wealth Management Aml Quality Control Effective Anti Money Laundering Prezentaciya Onlajn

The world of rules can seem like a bowl of alphabet soup at times. US cash laundering laws are no exception. We've got compiled a listing of the highest ten cash laundering acronyms and their definitions. TMP Danger is consulting firm centered on protecting monetary services by lowering danger, fraud and losses. We've got big financial institution expertise in operational and regulatory threat. Now we have a robust background in program administration, regulatory and operational danger in addition to Lean Six Sigma and Enterprise Process Outsourcing.

Thus money laundering brings many adverse penalties to the group because of the risks it presents. It will increase the probability of main dangers and the chance cost of the bank and finally causes the financial institution to face losses.